pa local services tax deductible

I have an LST or Local Services Tax in box 14. Wheres My Income Tax Refund.

Lawn Business Tax Write Offs Lawn Love

Employers with worksites located in Pennsylvania are required to withhold and remit the local Earned Income Tax EIT and Local.

. In general the deductions and exemptions used to calculate a taxpayers federal adjusted gross income or. Pennsylvania Act 7 of 2007 amended the Local Tax Enabling Act Act 511 of 1965 to make the following major changes to the Emergency and Municipal Services Tax EMST effective for. For Type select Other after tax.

This is listed on my W2 in box 14 as PA LST 52. All employers located within Middletown Township must withhold the Local Services Tax at the annual rate of 52 for all employees with annual gross income from wages in excess of. The Local Services Tax is a local tax payable by all individuals who hold a job or profession within a taxing jurisdiction imposing the tax.

If you live in PA and open a non-PA ABLE account you may miss out on important benefits. LST is also known as the head. Get your taxes done.

Local Income Tax Requirements for Employers. Turbo tax imported this as Other mandatory deductible state or local tax not listed. Would the category for that be Other mandatory deductible state or.

If your municipality charges a local services tax LST you may be wondering if the amount from your W-2 box 14 LST category can be deducted on your federal income taxes. The Local Services Tax shall be deducted for the municipality or school district in which you are employed. Federal Deductions and Exemptions Not Allowed For Pennsylvania Tax Purposes.

If the enacted LST rate exceeds. Turbo tax imported this as Other mandatory deductible state or local tax not listed. Under Deductionscontributions select Add deductioncontribution.

Ad PA residents who save in PA ABLE get benefits that other states ABLE plans cant provide. The Local Services Tax is a local tax payable by all individuals who hold a job or profession within a taxing jurisdiction imposing the tax. Thus it is not a deductible local income tax.

In tracking it down I found that my deductions for state and local taxes are off. Ad PA residents who save in PA ABLE get benefits that other states ABLE plans cant provide. This tax is withheld based on employment location for both.

In the past it could be deducted as a unreimbursed. In the Deductions for Benefits section select Add a Deduction. How and when is the tax deducted from my pay.

Employees working in Pennsylvania are subject to the annual Local Services Tax LST. For Deductioncontribution type select Other taxable deductions. Local governments may wish to consult with their solicitors on whether and how they might explore alternatives to waive interest andor penalties for local tax filings and payments that.

The PA Local Services Tax is an employment related tax not based upon income amount. It is due quarterly on a prorated basis. Formerly the Emergency and Municipal Services Tax Pennsylvania Act 7 of 2007.

It is due quarterly on a prorated basis determined by the. I tracked down the difference to my local services tax LST. If you live in PA and open a non-PA ABLE account you may miss out on important benefits.

Formerly the Emergency and Municipal Services Tax Pennsylvania Act 7 of 2007 amends the Local Tax Enabling Act Act 511 of 1965 to make the following major changes to the. Property TaxRent Rebate Status. Pennsylvania Department of Revenue Im looking for.

Pennsylvania Local Services Tax.

Real Estate Investments And Travel What Can You Deduct Luxury Property Care

Can You Deduct Pest Control Services From Your Taxes

Gross Vs Net Income How Do They Differ Smartasset

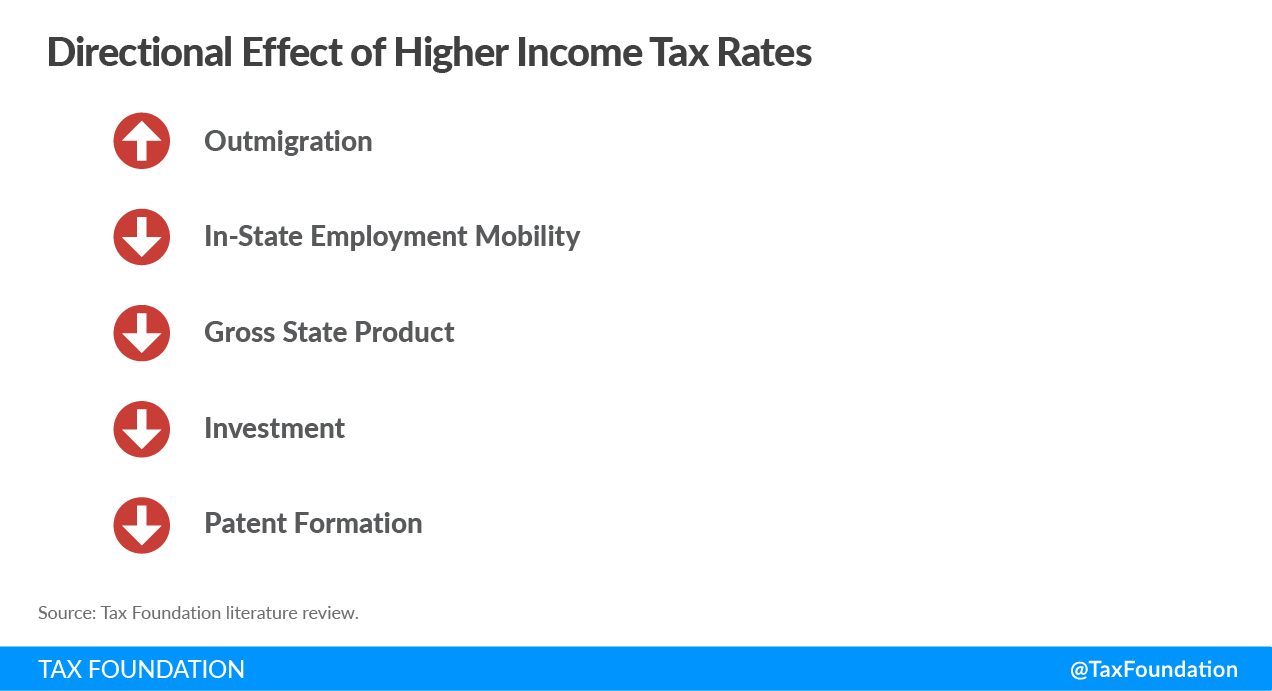

Taxes And The Economy Tax Foundation

19 Truck Driver Tax Deductions That Will Save You Money Truckstop Com

State Corporate Income Tax Rates And Brackets Tax Foundation

York Adams Tax Bureau Pennsylvania Municipal Taxes

State Corporate Income Tax Rates And Brackets Tax Foundation

State Corporate Income Tax Rates And Brackets Tax Foundation

6 Locum Tenens Tax Deductions You Didn T Know About

Pennsylvania Tax Rates Things To Know Credit Karma

Real Estate Investments And Travel What Can You Deduct Luxury Property Care

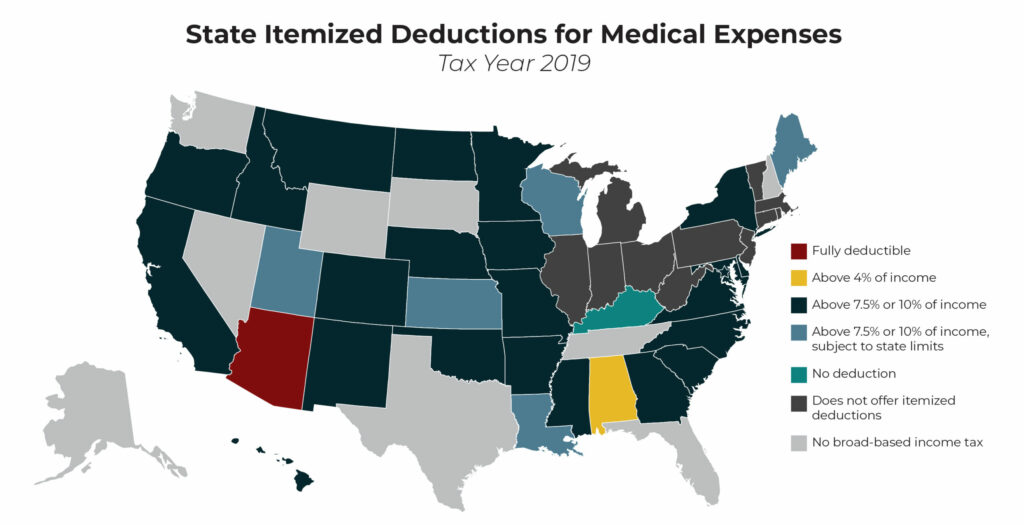

State Itemized Deductions Surveying The Landscape Exploring Reforms Itep

Real Estate Investments And Travel What Can You Deduct Luxury Property Care

Pa Lawmakers Agree To Boost Education Funding Spend Billions In Remaining Stimulus Money As Part Of Budget Spotlight Pa

State Corporate Income Tax Rates And Brackets Tax Foundation